Why We Believe Rates Will Be Higher for Longer and What It Means for Bond Investors

“We are navigating by the stars under cloudy skies.” -Federal Reserve Chair Jerome Powell The Fed is likely underestimating the neutral level of the fed funds rate, which it had at 2.6% in its last summary of economic projections, and will probably need to revise it higher. We believe the Fed’s neutral rate is …

Talking About the Future of Carson Group with Burt White

Discover the vision and strategy behind Carson Group’s evolution as Burt White steps into the role of CEO! In this episode, Ryan Detrick, Chief Market Strategist at Carson Group & Sonu Varghese, VP, Global Macro Strategist at Carson Group, sit down with Burt White, CEO at Carson Group, to explore the company’s direction under his …

The Bears Are Back, Why That’s a Good Thing

“Even a broken clock is right twice a day.” Some well-known bears are back in the news, with their usual dour predictions, from a recession coming soon to an outright 65% market crash. You can read more about their calls here, but we’ve been hearing these same things for years now and been pushing …

AIs on the Prize: Unleashing the Power of AI’s Sight

Breakthroughs in computing power have bestowed upon computers the remarkable ability to “see.” A transformative development that not only encompasses the capacity to recognize and interpret images but also to generate entirely new visual content. Previously, computers could only index images based on textual descriptions provided by humans. For instance, an image might be labeled …

Our Leading Economic Indicators Still Point to a Strong Economy

We recently got a couple of softer than expected economic report cards – Q1 GDP growth and the April payroll report – and suddenly we’re hearing more about an impending recession. In fact, the combination of these reports with hotter than expected inflation in Q1, has raised chatter about the dreaded “stagflation” scenario, i.e. low …

Talking About Everything Under the Sun with Eddy Elfenbein

The art of stock picking is a skill that can lead to significant rewards for those who master it. How does one sift through the noise to identify undervalued gems? What does it take to maintain a long-term perspective in a market driven by short-term sentiments? In this episode, Ryan Detrick, Chief Market Strategist at …

Six Reasons This Bull Market Is Alive and Well

“Sometimes the questions are complicated and the answers are simple.” -Dr. Seuss 2024 came out swinging, with the S&P 500 up more than 10% in the first quarter on the heels of adding more than 11% in the fourth quarter of ’23. Back-to-back double-digit quarters are quite rare, but the good news is they …

Nvidia’s Golden Tickets: Amazon, Microsoft, Google Amplify AI Investments

Six of the magnificent seven stocks have reported earnings: Apple, Tesla, Alphabet, Microsoft, Amazon, and Meta. They are buzzing about the seventh, Nvidia. Companies are scrambling to get their hands on Nvidia’s computing chips as if they were Wonka Bars that might have golden tickets. They are spending enormous sums of money to harness AI’s …

The April Employment Report Tells Us the Economy Is Strong, But Not Red Hot

The April employment report was the first one in months that went well against market expectations. Three blockbuster payroll reports in Q1 had conditioned sentiment towards expecting more of the same, but instead we got something less blockbuster(y). Payrolls grew 175,000 in April — below expectations of 240,000 and lower than the red hot Q1 …

Powell and the Fed Keep Their Eye on the Big Picture

The big picture, coming out of the Federal Open Market Committee (FOMC) meeting is that inflation has eased considerably since last year, but it remains elevated. As a result, they’re choosing to maintain policy rates where they are (in the 5.25-5.50% range). At the same time, Federal Reserve Chair Jerome Powell believes the disinflation process …

Bonds Just Finished Their Roughest Three-Month Seasonal Period

In yesterday’s blog, our chief market strategist Ryan Detrick took a look at “Sell in May and go away” and provided a lot of important insight on what it may mean in current market context. While we’re entering a period of historical seasonal weakness, the seasonals alone aren’t strong enough to drive a change in …

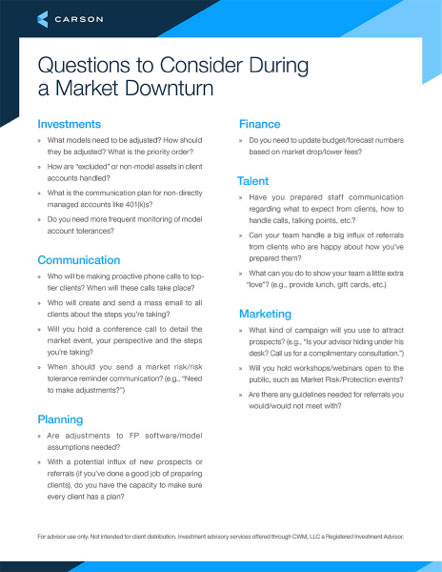

Download A Complimentary Resource

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable.